what does liquidating stock mean

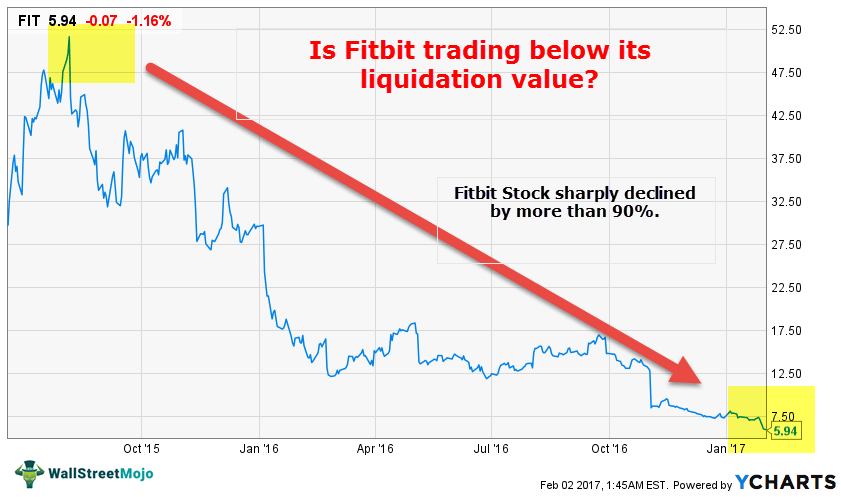

Corporate stock as a whole can be liquidated if a company files bankruptcy or if a company is bought out or taken over. In a nutshell a delisting means the stock is being evicted from the major trading exchange and relegated to the less liquid OTC and.

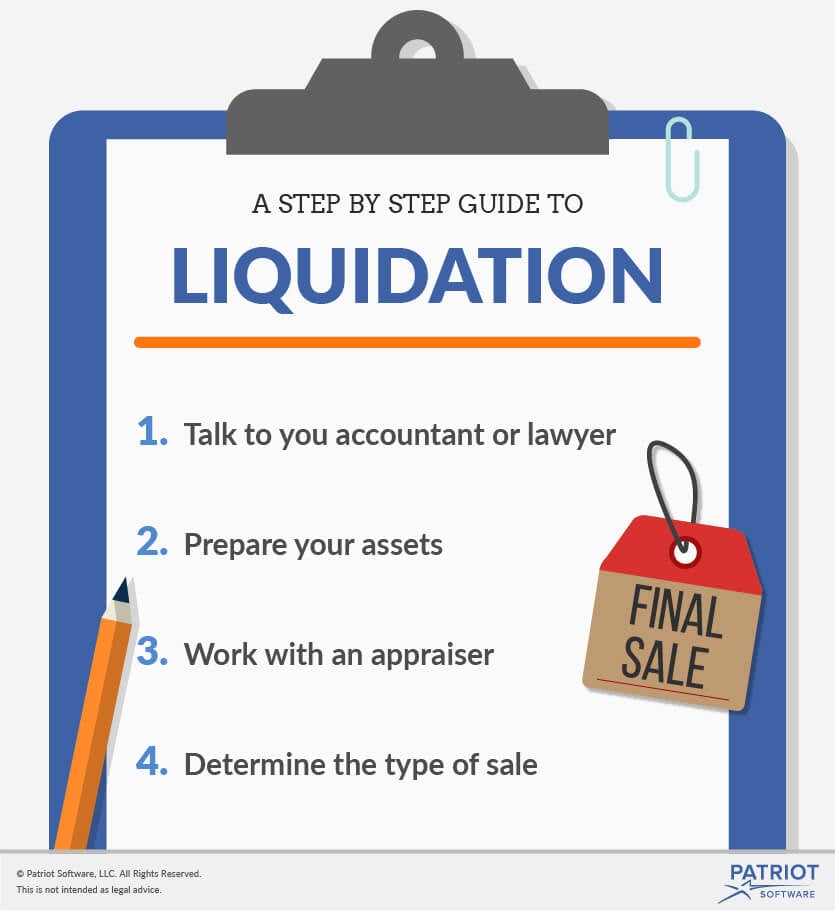

Liquidate A Company What Are The Steps To Be Taken

Typically those assets are the companys inventory and theyre sold at a deep discount.

. Liquidation in most cases is part of closing down or restructuring a business. Explore the latest videos from hashtags. The price of a stock is continually fluctuating based on market conditions which makes it unusable for daily transactions just try paying for lunch with a share of Johnson Johnson.

Stock liquidation which refers to selling stock in a company in exchange for money is something that occurs for various reasons. Share price of at least 1. Stock liquidation can have a number of different meanings but the common theme is that the stock is sold in exchange for money.

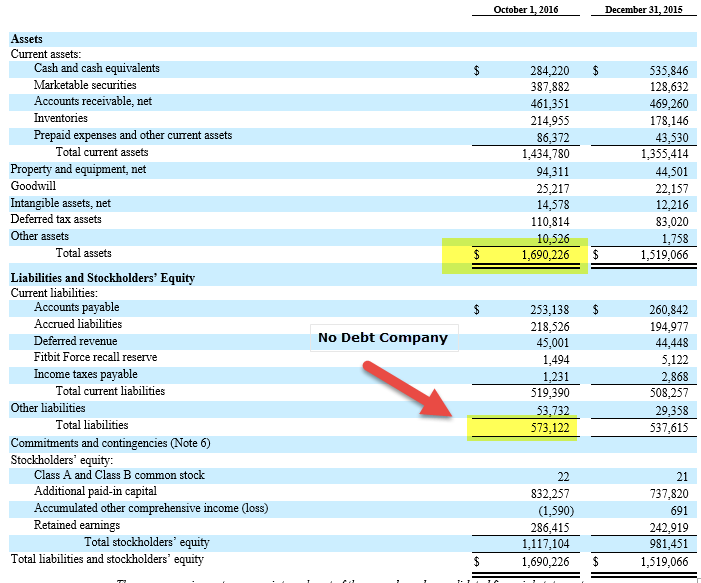

Any stock or inventory could be considered current assets if the business is able to sell them quickly and easily. The liquidation of a. This happens when the business of a company is closed.

The liquidation level normally expressed as a percentage is the point that if reached will initiate the automatic closure of existing positions. While any asset or investment can be liquidated this type of sale often refers to the process of disposing of all assets of a company that has filed for bankruptcy a legal process in which the company declares it cant pay its debts and works to settle with its creditors. Gabe Felicianopinoyplug Swanky Cops swankycops karameleonvintagekarameleonvintage DYLAN SANGLAY dsanglay Adventurous Pup Coadventurouspupco.

In the context of cryptocurrency markets liquidation refers to when an exchange forcefully closes a traders leveraged position due to a. Errol Coleman errol_coleman Freddie Finance freddiefinance Stocks Bonding Podcast stocksnbonding Yahoo Finance yahoofinance WolfonRobinhood wolfonrobinhood. The assets are sold and the proceeds used to repay creditors.

Stocks with low liquidity may be difficult to sell and may cause you to take a bigger loss if you cannot sell the shares when you want to. The Nasdaq has three primary requirements to stay in compliance. Liquidating any stock holding particularly a large stock portfolio is a serious undertaking.

When a company faces a delisting it means its being taken off of the major exchanges like the NYSE NASDAQ and AMEX onto the over-the-counter OTC or Pink Sheets unless its being taken private. Other examples are when one company acquires another and sells off its shares and when a company ceases operations. Any remaining assets may be distributed to the companys owners.

A stock liquidation occurs when stock shares are converted into cash. Watch popular content from the following creators. Call your stockbroker to discuss your choices in liquidating your stock.

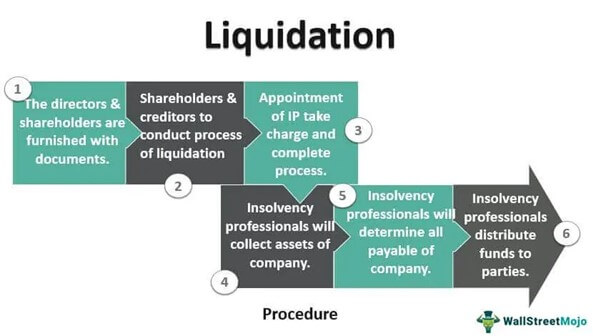

Purchase in Evening up Offset liquidity. Liquidation is the process of selling off all the assets of an entity settling its liabilities distributing any remaining funds to shareholders and closing it down as a legal entity. The ideal way for stock to get liquidated is.

Transactions that close or offset a short or long -term position. In most instances stock liquidation occurs when shareholders sell their shares on the open market for ready cash. Liquidation is the process of turning assets into cash.

When does a stock get delisted. Liquidity risk is the risk that investors wont find a market. Discover short videos related to what does dead stock mean on TikTok.

There are a number of reasons that can cause a stock to be delisted. To make it usable stockholders need to sell it ie liquidate it to lock in its value. Liquidating a stock means selling it for cash.

A stocks liquidity generally refers to how rapidly shares of a stock can be bought or sold without substantially impacting the stock price. Current assets are something that can be liquidated within a couple of weeks. Bankruptcy is related to a.

One reason for stock liquidation is if a company files for bankruptcy. Watch popular content from the following creators. Liquidation is the selling of assets to raise cash usually to pay off debts.

Any leftovers are then distributed to shareholders. The liquidation process is a possible outcome of bankruptcy which a company enters when it does not have sufficient funds to pay its creditors. In Stock Market Dictionary.

Whatdoesitmeantoyou whatdoesitmeantrend whatdoesotmean. Explore the latest videos from hashtags. Liquidating trade means atransaction whereby for the purpose of closing out a futures contract the person in the bought position or sold position under the futures contract assumes an offsetting sold position or offsetting bought position as the case may be under another futures contract.

Businesses that operate in a niche market may find it challenging to sell off their current inventory quickly. In the context of cryptocurrency markets liquidation refers to when an exchange forcefully closes a traders leveraged position due to a.

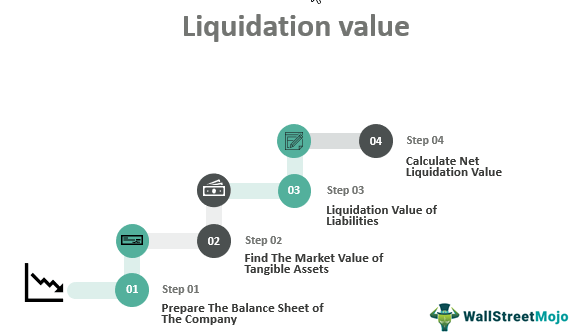

Liquidation Value Formula Example Step By Step Calculation

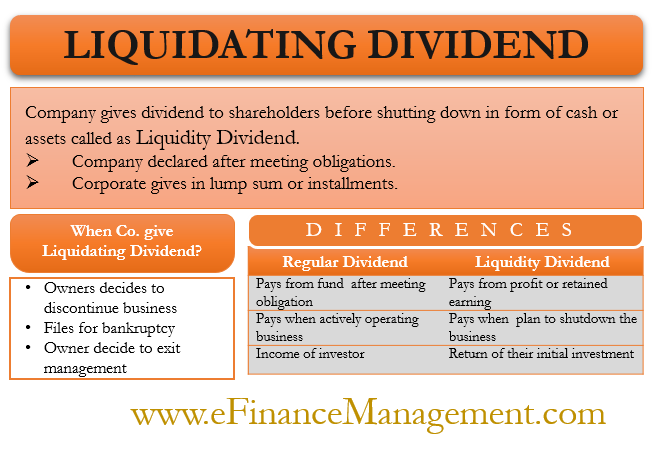

Liquidating Dividend Meaning Example And More

What Is Liquidation Approach Capital Com

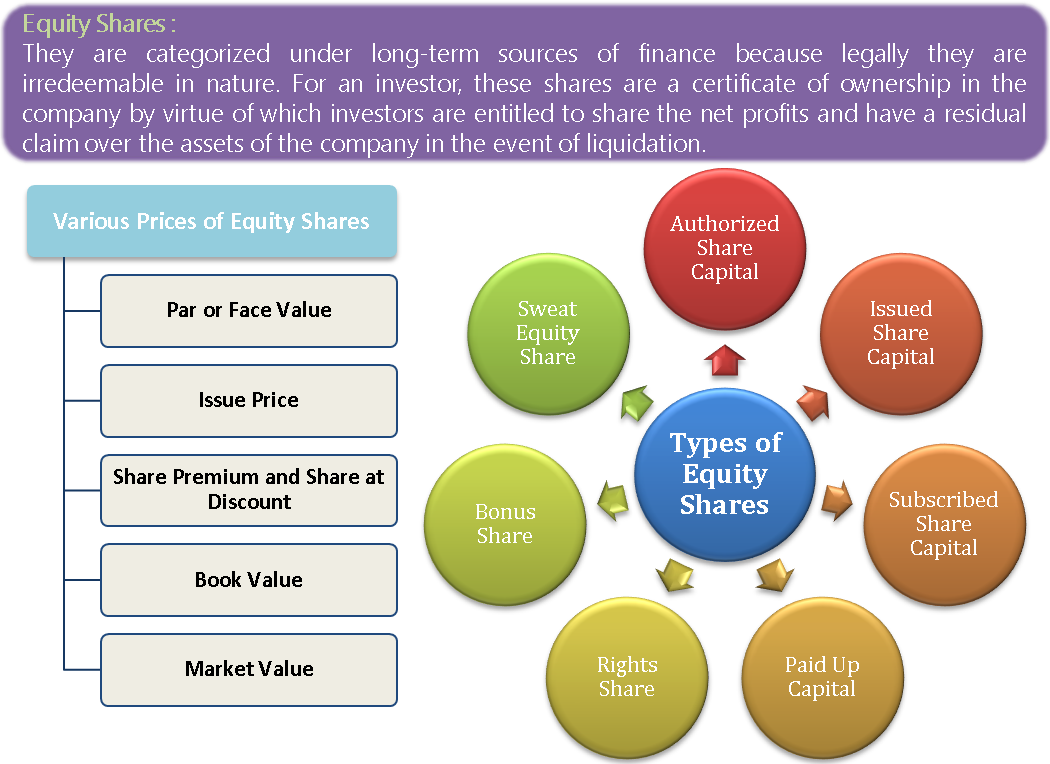

Preferred Shares Types Features Classification Of Shares

Small Business Liquidation What Is Liquidation In Business

Liquidation Value Formula Example Step By Step Calculation

Understanding Voluntary Liquidation In Uae Liquid Equity Understanding

Liquidation Meaning Process Types Examples Consequences

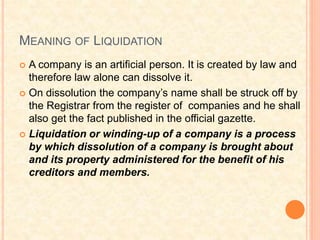

Meaning Of Liquidation Reasons For Liquidation And Calculation Of Liquidator S Remuneration The Accounting Brain

Liquidation Value Formula Example Step By Step Calculation

Types Of Dividend In 2022 Dividend Financial Management Investing

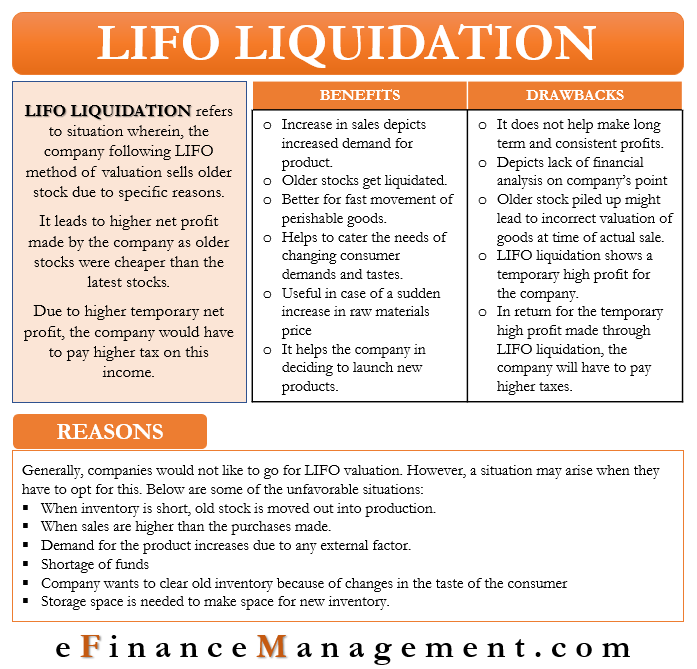

Lifo Liquidation Meaning Use And Example Efinancemanagement

Is There A Hedge Fund Crowding Factor Msci

Winding Up Definition And Meaning Market Business News

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Stock_2020-01-03fbeb0664c74b71aa025dcfd7661c82.jpg)